Driving personalization of benefits to deliver on what members need

Philip Kaufman explores the ways in which UnitedHealthcare offers an improved member experience using personalization, advocate support and more.

By Philip Kaufman, Chief Operations Officer, UnitedHealthcare Employer & Individual.

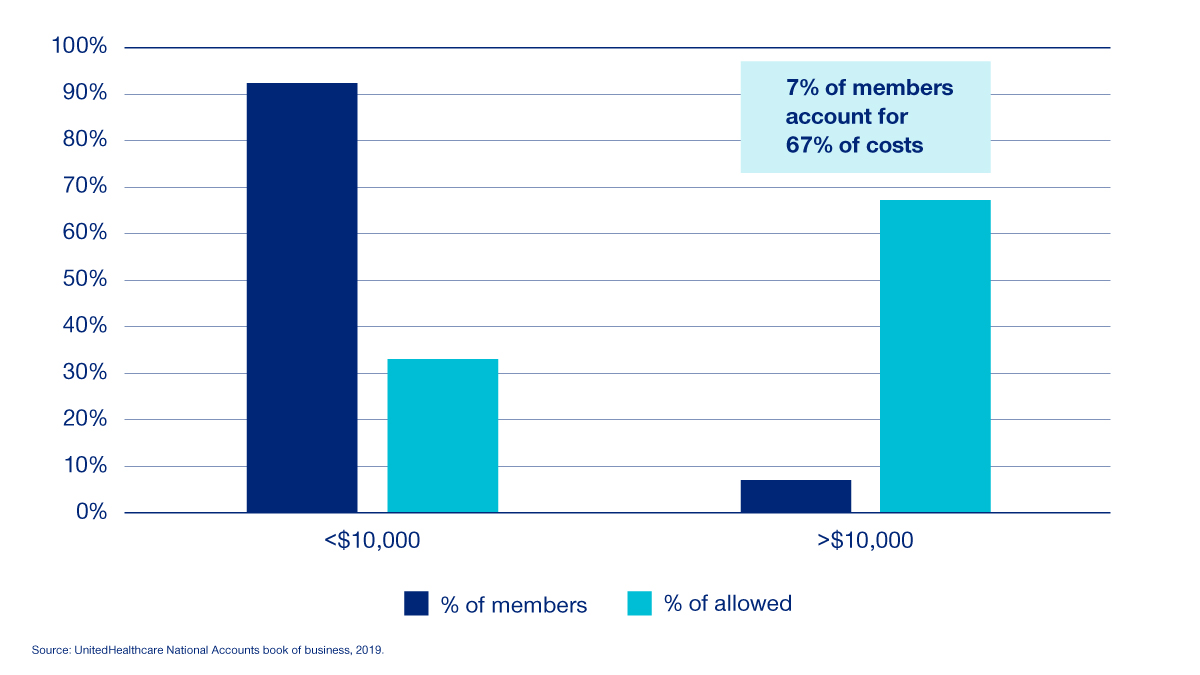

It’s long been true that a large portion of a typical U.S. employer’s health care spend stems from a small segment of employees. Out of 100 people in any plan, about 10 individuals with complex and chronic needs will generate roughly 70% of the spend1. The other 90% of employees typically use their plan only a few times a year — for an annual physical or to fill a prescription.

This is what I think of, broadly speaking, as the 90-10 health care reality — and it’s reflected in some UnitedHealthcare data highlighted in this visual:

Given the dramatically different health care needs, an important question arises: How should we create plans and benefits strategies geared toward each group, tailored to their unique situation?

We want to keep healthier employees healthy. And we want to help those with more serious needs receive more effective and efficient care to drive positive outcomes and reduce costs. Failing to build strategies that account for the needs of specific groups risks further widening health disparities that exist today.

This is why we’re working with brokers, consultants and employers to build benefits strategies grounded in engagement and personalization.

Advocacy and support for those who need it most

Let’s start with the 10% of an employee population with complex needs. On average, those with complex care needs are likely to:

- Generate 5 times more claims2

- Have hospital stays that are 10 times longer3

- Use out-of-network providers 11 times more4

These employees and their families can benefit from targeted services that help them navigate the health care system. At UnitedHealthcare, we’ve created programs geared toward populations with acute health care needs.

- The Special Needs Initiative assigns an advisor to families with children who have special health care needs. This advocate supports every member of the family (not just the child) and takes responsibility for each inquiry that surfaces along a care path and can include helping to drive coordination with the child’s care team.

- The Complex Care Concierge program, piloted in 2020 and built on learnings from the Special Needs Initiative, supports adults with complex needs in a similar way.

With both programs, a trusted care advisor is engaged early and often. This advocate is all about optimizing people, process, organizational structure and technology in trying to create a seamless experience for employees and their families.

For healthier populations, engagement is a focus

For the great majority of members whose health care needs are less frequent, it’s important to maintain their engagement in wellness programs to help maintain healthier habits — and keep costs lower for an employer. The goal is to help these members build healthier habits through value-add experiences and services in the realms of exercise, sleep and diet.

I see relationships with consumer brands as crucial here, as engaging individuals on their health BEFORE they need the system can be challenging. Leveraging places where consumers already participate helps make that engagement easier. It’s about meeting members where they are and collaborating with products and experiences they know and respect.

The overarching goal is to incentivize healthier habits, gaining momentum around certain behaviors to help members save money while improving their health.

But this isn’t just about trusted consumer brands — it’s also about trusted physicians. We need to be real about the fact that insurance companies are not the most trusted player in the health care system — that’s the physician and more broadly the clinician’s team including nurses. So, part of our strategy is working with clinicians to help deliver information and promote tools designed to engage members — one recent example is Point of Care Assist® (POCA).

Putting members in the driver’s seat

A winning benefits strategy is built on personalization. Members aren’t passive in their everyday consumption habits digitally or in person — access to goods and services at the fingertips is the expectation — and it’s no different for their health care. They want to feel in control of their benefits experience, and they seek plan options dialed in to their needs. What matters most is going beyond one-size-fits-all offerings to help meet members where they are with tailored services, wellness experiences and plans.

For example, we’re evolving the digital experience to allow for customized member-portal dashboards and seamless access across devices and platforms. It’s about helping people get the type and level of information they need so they can better understand and use their benefits — whether they use them frequently or only a couple times a year. We also are working with employers to allow them the ability to offer more plan options at time of enrollment.

We are relentless in our efforts around this and I know that it will be a journey. I am a Bruce Springsteen fan and like this quote from him on delivering on behalf of the “audience” — for us, that’s our employer clients and their employees and their families: “Getting an audience is hard. Sustaining an audience is hard. It demands a consistency of thought, of purpose, and of action over a long period of time.”

Philip Kaufman

Chief Operating Officer

UnitedHealthcare Employer & Individual

Philip Kaufman is Chief Operating Officer of UnitedHealthcare Employer & Individual (E&I), where he is accountable for aligning and leading the strategy, operations, product, marketing, advocacy, digital and business advancement functions in support of and in close collaboration with E&I’s businesses.

Philip previously served as Chief Executive Officer of UnitedHealthcare of Minnesota, North Dakota and South Dakota, where he brought together the enterprise capabilities and functions needed for the successful launch in these new markets. Over the last 18 years, Philip has held several leadership positions within UnitedHealth Group, including President of UnitedHealthcare Specialty Benefits and Chief Executive Officer of UnitedHealthcare Vision.

Prior to joining UnitedHealth Group, Philip worked in mergers and acquisitions for the Rothschild Group and Deutsche Bank AG.

Philip holds a Master of Business Administration from Harvard Business School, a Master of Health Care Delivery Science from Dartmouth and Bachelor of Arts in Economics from Harvard University. Philip sits on the Board of Directors for the Minneapolis St. Paul Economic Development Partnership, as well as the Board of Directors for the Minnesota Chamber of Commerce.