White paper: More affordable care matters

Taking a strategic, end-to-end approach to cost management is critical for employers looking to reduce costs without compromising their employees’ quality of care or coverage.

Health care spending in the U.S. is expected to reach $6.8T by 2030, a trend that doesn’t show signs of reversing itself anytime soon.1 For employers, that translates to a 7% forecasted increase in medical costs for 2024,2 including double the number of claims surpassing $3M or more since 2016.3

Some of these increases can be attributed to the economy, the shortage of health care workers driving up unit costs and the persistent surge in pharmacy costs — largely due to an influx of high-cost specialty drugs in the pipeline.4 As a result, some employees are forced to make tough decisions around deferring or delaying care: In fact, nearly half of U.S. adults with average or lower incomes said that cost was the reason they skipped some medical care over the past year.5

Yet, despite the added pressure on their bottom lines, many employers are not willing to compromise on the quality of health benefits they offer, nor are they willing to raise employee contributions to offset their own costs.6 That’s why taking a strategic approach to cost management is so critical.

“There’s a lot of frustration with the uncontained inflation in health care. The only thing this inflationary in our economy other than health care is higher education.”

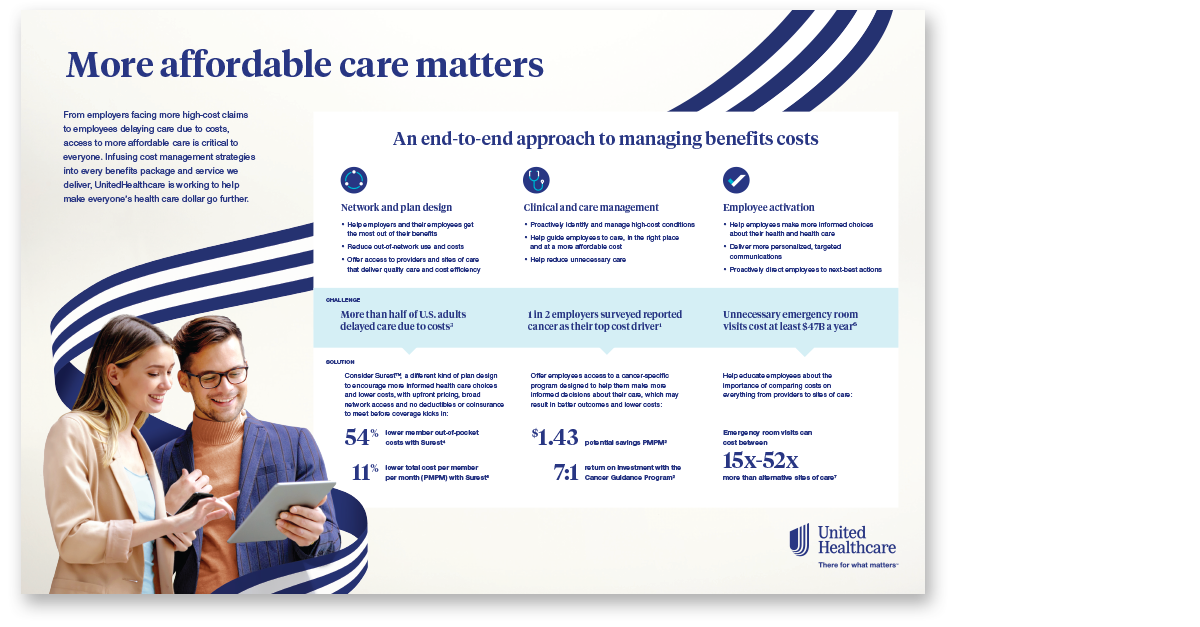

Strategies that may prove effective for employers include:

- Investing in health plans and networks designed to help make quality care more affordable

- Providing clinical and care management programs that support better health outcomes and lower costs

- Empowering employees with tools and resources that enable more informed health decisions and healthier lifestyles

A one-pager on cost management

An overview of the UnitedHealthcare strategies built to drive more cost savings for both employers and employees while also contributing to better outcomes.

Health plans and networks designed to help make quality care more affordable

When it comes to group health insurance plans and provider networks, thoughtful design matters. Understanding and selecting the right medical plan and network configuration for their employee population can help ensure employers and their employees get the most out of their health insurance.

Traditionally, employers may have considered the following before choosing a health plan:

- What is the cost to employees? What is the deductible? What is the coinsurance?

- How much of the employee contribution to benefits costs will the company want to cover?

- What type of network access does the health plan offer?

Those are good questions — and answers can often be found in health plan design and network configurations.

Helping employees get the most out of their plan dollars

Perhaps the most obvious way to tackle the cost of health care is to reduce the amount employees have to pay for their health benefits and health care, before coverage kicks in and when the bill arrives. In other words: premiums, deductibles, coinsurance and copays.

Despite the forecasted increase in employer health care costs for 2024, only 16% of surveyed employers said they planned to raise their employee health care contributions — a 6% decrease from the previous year.2 In fact, most employers elected to cover 80% of their employees’ health care premiums for those in single coverage medical plans and only slightly less for those under a family plan.7

Because many employers are not willing to pass costs on to their employees, it’s clear they care about reducing costs for their employees. That’s why plans that offer no deductibles or coinsurance, as well as greater visibility around cost and quality, are becoming an attractive option to both employees and employers.

Plans without deductibles and coinsurance allow employees to get more immediate perceived value out of their health plan compared to having to satisfy a deductible before the plan contributes to costs. These copay-only plans can also eliminate some of the complexity and confusion for employees, especially considering up to 77% of those surveyed struggled to define “coinsurance” and other basic health care terms.8

Greater transparency into cost and quality information may help employees make more informed decisions along the way as well, which can have ripple effects for their health and the cost of care. For instance, seeing the cost differential between an urgent care and ER visit may encourage employees to choose a lower-cost site of care for a nonemergency situation, which can drastically cut down on costs for themselves and their employer.10

Employers can also consider pairing a health plan with an employer-sponsored flexible spending account (FSA) or health savings account (HSA) to offset employee health care contributions since these accounts allow employees to set aside pretax money to help cover health care expenses.

Additionally, if employers have large numbers of employees or employees with family members who are living with chronic conditions like type 2 diabetes, they may want to consider investing in a health plan that is designed specifically to help manage that condition and its related costs.

“These days, health plans must be characterized by simplicity, affordability and personalization.”

Tapping into quality provider networks

Pairing a health plan with a network that prioritizes providers and health systems with proven quality and cost efficiency may have the power to move the needle on costs long-term.

Broad networks can give employees more options when it comes to choosing a provider and site of care that fits their needs, preferences and budgets. At the same time, while more narrow networks may feel limiting to some employees as they provide guardrails around which providers and sites of care they can visit, these network constructs can help ensure employees are getting care that is medically necessary and cost efficient.

For example, plans and networks that encourage or even require employees to establish a relationship with a primary care provider (PCP) who can coordinate and manage their care, including referring out to specialists when needed, have the potential for reduced costs.

Network strategies that pay groups of providers based on the quality of care delivered rather than the volume of services rendered can also help generate better health outcomes and more cost-efficient care. This is the concept behind value-based care arrangements and Accountable Care Organizations (ACOs). Plus, it’s what many employers are asking for, with 58% of surveyed employers wanting additional reporting and better provider quality measurement standards.3

Centers of Excellence (COEs) offer another approach — a network of clinically superior, cost-effective health care centers that support complex medical conditions, including cancer and congenital heart disease, as well as bariatric, neonatal and transplant needs. COEs are built to enable:

- More accurate diagnoses

- More coordinated and appropriate care

- Better health outcomes and higher survival rates, with fewer readmissions and complications

- Lower costs for procedures

- A simpler billing and payment experience

Having access to this kind of curated network matters when an employee or their family member is dealing with a complex condition. Overall, an effective network strategy helps guide employees to providers and sites of care that deliver quality, cost-efficient care, resulting in lower net paid costs, fewer ER visits and shorter inpatient stays for their patients.11

- Up to 15% in employer savings for ACO networks12

- 10% lower total cost of care among designated high-value physicians13

Clinical and care management programs that support better health outcomes and lower costs

The prevalence of complex and chronic conditions — and the costs that accompany them — demands clinical and care management programs built to help employees better navigate their care journey. In fact, two-thirds of employers indicated that one of the top 3 areas in which they are seeking the most support in the next 5 years includes strategies for improving care management for high-cost conditions.11

That may look like a cancer-specific program designed to offer employees personalized support in managing their cancer journey, helping them better understand their diagnosis, treatment options and more. Programs like these may also help employees make more informed decisions about their care, which can result in better outcomes and lower costs. Employers may see financial savings, too, through contractual discounts and quality-related cost-avoidance savings.

Delaying or deferring preventive care, ignoring care recommendations or even receiving inappropriate or unnecessary care may result in suboptimal health and higher costs. That’s why programs that use data and analytics to enable more personalized care can make a real difference in the lives of employees who are managing high-cost conditions.

“Clinical and care management programs are all about providing employees with end-to-end support across the entire health care continuum, which can result in better health outcomes and reduced costs.”

Clinical strategies, for instance, that help guide employees to the right care, in the right place and at the right cost may help alleviate some of employers’ high costs. Programs that help ensure clinically appropriate procedures and bed days may also result in savings.

As the workforce continues to age and chronic conditions grow in prevalence, clinical management strategies like these will become even more important in containing costs.

Did you know?

- 6 in 10 U.S. adults were managing a chronic condition14

- ~70% of of stop loss claims came from 10 conditions15

- 1 in 2 employers reported cancer as their top cost driver3

Tools and resources that enable more informed decisions and healthier lifestyles

The more employees know, the better decisions they may make concerning their health — and the costs associated with their care.

Employers can help employees get more engaged with their health in a variety of ways, starting with simply encouraging them to make full use of the benefits and resources available to them. In fact, research showed that higher levels of health plan and program engagement are linked to improved health outcomes, lower costs and higher productivity.16

Helping employees live a healthier life can also impact the costs employers are on the hook for, especially since healthy behaviors have been found to contribute as much as 50% of a person’s health status.16 Offering programs that encourage and reward employees for making informed and healthier lifestyle decisions can reinforce employee ownership over their health and drive lower health care costs long-term.

Ensuring employees have access to the information they need to make more informed decisions also matters.

While it’s important that a carrier provides visibility into quality and cost information through its portfolio of offerings, employers may want to take this into consideration when selecting the products, benefits and tools they offer. This is especially the case for younger employees coming into the workforce who may be unfamiliar with how to navigate the health system.

Additionally, employers can work with their carrier and benefits administrators to further educate employees about the impact their decisions can have on their health — and their wallets. More effective use of the health system may help employees get more out of the dollars they spend on health care and deliver savings back to the employer.

“We can empower employees to make optimal health care decisions by making the information they need to do so available at their fingertips.”

Providers also have a role to play, and that’s why point-of-care solutions that integrate an employee’s health plan information with a provider’s electronic medical record (EMR) system are so important. These tools allow providers to see which prescriptions are covered and which aren’t, whether there is a lower-cost alternative available and which facilities may be more affordable.

Taking a proven approach to cost management

UnitedHealthcare is committed to reducing the cost of care and understands that doing so requires employers to have the right health plan and network, employee access to clinical and care management programs and the tools and resources needed to make informed decisions.

This strategic approach, paired with the work UnitedHealthcare is leading to help reduce waste and ensure employees are billed appropriately, has proven to deliver around a 10% average lower total cost of care compared to competition.18