A health plan design that is proving to be simpler and more cost-effective for employers and employees

Adding Surest as a health plan option helped several employers achieve lower costs and a simpler experience for their employees.

Fatigue in finding a health plan that satisfies employee needs and an employer’s bottom line. Anxiety that stems from employee confusion over costs, ranging from provider visits to prescriptions. Discouragement in trying to search for a health plan that bridges the gap between quality care and lower costs.

These are some of the challenges and frustrations employers may face when evaluating health plan options. But the Surest™ health plan from UnitedHealthcare offers a different experience for large, midsize and small employers (with 51+) and their employees.

On top of offering a digital and mobile app experience that is designed to be simple, Surest has shown the ability to drive better health outcomes and lower costs. In fact, the out-of-pocket costs for Surest members are 54% lower than the national average.1 Plus, employees who are Surest members tend to prioritize preventive care and require fewer surgeries:

- 34% increase in preventive colonoscopies2

- 5% increase in preventive mammograms2

- 9% increase in preventive physical exams2

- 5% reduction in overall surgeries3

Employers also experienced reduced costs with Surest, saving up to 11% per member per month (PMPM).4 Read how these results have taken shape for employers of various sizes, geographies and industries and what some employees have to say about having Surest as their health plan of choice.

Proof is greater than promises: Employer case studies

Lumen, a telecommunications company based in Louisiana, needed a health plan that would help their employees live healthier lives while also managing costs for their employees’ costs and their own. The result: 16% lower PMPM cost; 52% lower out-of-pocket spend compared to traditional plans; 62% of Lumen members said the plan made them healthier.

Medtronic, a medical technology company based in Minnesota, wanted to attract and retain top talent while also improving employees’ quality of life. Keeping employee benefit increases at a minimum was another goal. After offering the Surest health plan, Medtronic reduced their costs by 16% and employees chose the most cost-effective treatment paths for themselves 91% of the time.

With employee turnover a problem in the retail industry, Slumberland, a retailer based in Minnesota, needed a health plan with price clarity and a broad provider network that could help attract and retain employees while allowing the company to remain cost conscious and competitive. After years 1 and 2, employees with the Surest health plan reduced their costs by about 50%.

Dayton Children’s Hospital, based in Ohio, wanted its benefits to align with its philosophy of reducing worry and stress among the lives of their employees, so they can give their best to the children they treat. In addition to appreciating the support Dayton Children’s Hospital received from Surest, employees also appreciated how easy it was to compare prices for their care, resulting in 83% choosing some of the most cost-efficient options.

Cache County School District, based in Utah, needed to reduce health care costs for the district and its employees. After it offered the Surest health plan, employees saved 55% in out-of-pocket savings. The school district also experienced 14% lower PMPM costs.

Cumberland School District, based in Wisconsin, was struggling to balance rising health costs and limited resources. The district wanted to find a health plan that could bridge budget and employee expectations. After switching the entire workforce over to the Surest health plan, the district saved $700,000.

The employee perspective

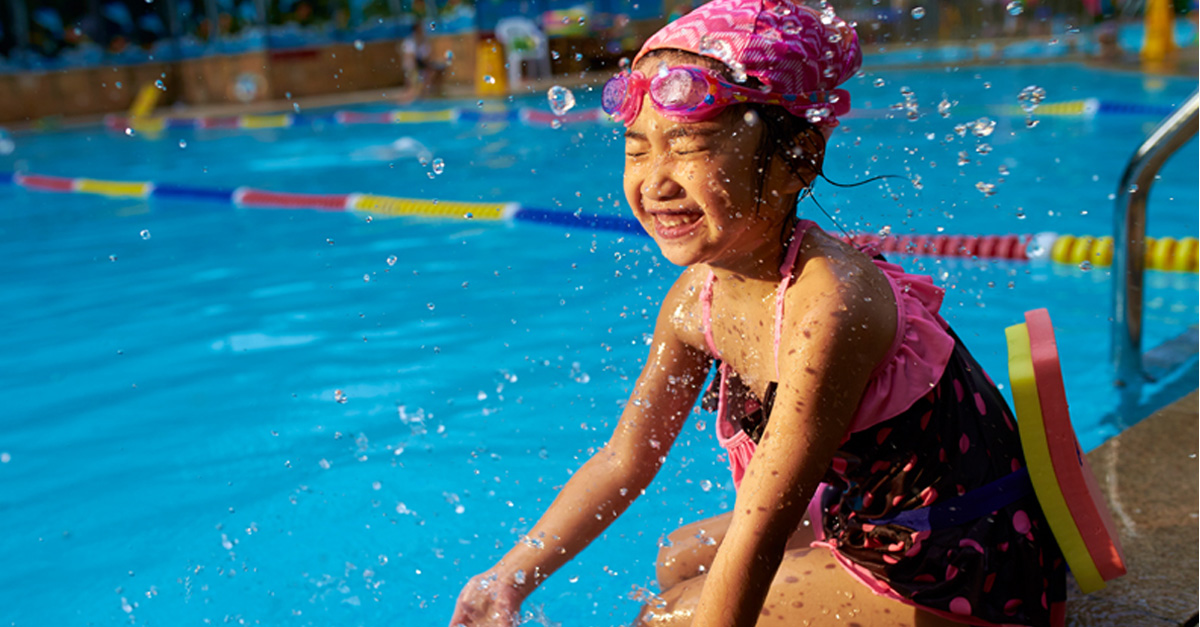

A Surest member who calls Pennsylvania home shares her perspective of how the Surest health plan enabled her to reduce her pregnancy costs and continues to help her save money as she cares for her 3 sons.

A Surest member who works for Ohio-based Kroger, a retail company that operates supermarkets, shares how Surest allows him to compare costs, saving his family tremendous amounts of money for their health care.