Studies show UnitedHealthcare beats competition on total cost of care using best-practice methodologies

Studies highlight UnitedHealthcare cost-savings strategies, validating savings methodologies across key programs and confirming the ability to manage savings better than the competition.

UnitedHealthcare is engaging third-party firms to help consultants, brokers and employers understand that a total cost of care strategy must extend beyond traditional discount analyses. According to studies from Wakely Consulting Group and ZS Associates, UnitedHealthcare is reducing employers’ total cost of care better than the industry average, and its savings methodologies are consistent with industry best practices for key programs.

Employer costs are a combination of unit cost — typically measured through discounts — and utilization. Traditional consultant analyses capture discounts but do not capture utilization, including savings from factors such as site-of-care redirection, payment integrity and bed-day management, among others. Because discount tools typically don’t include these factors — and, therefore, don’t fully measure total cost of care — employers historically lack visibility into the potential for long-term savings. These studies are designed to help ensure UnitedHealthcare is positioned accurately within requests for proposals and overall carrier evaluations.

Independent studies are enabling more transparent and accurate cost analyses

About the studies

Wakely Consulting Group: Looking at risk-adjusted allowed claims per member per month (PMPM), Wakely Consulting Group recently completed its second member cost-savings comparison and reaffirmed UnitedHealthcare outperformed the market by ≈10% — even though UnitedHealthcare is not the leader in discounts in many of the markets. In some cases, UnitedHealthcare lowered costs by up to 20%. These results, uncovered using 2021 claims data, were similar to findings from the initial 2019 study.

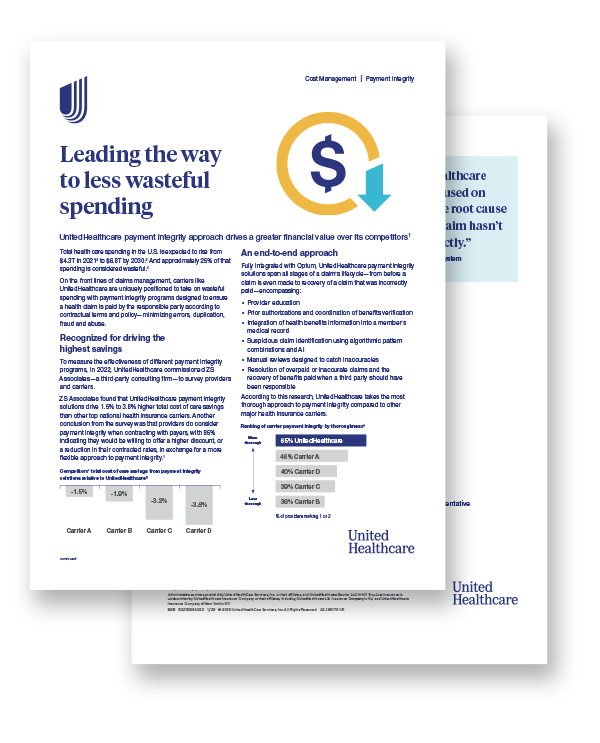

ZS Associates: In a survey of providers and carriers. ZS Associates found that UnitedHealthcare payment integrity solutions may help drive higher total cost of care savings than other top national health insurance carriers. Another conclusion from the survey was that providers do consider payment integrity when contracting with payers, with 85% indicating they would be willing to offer a higher discount, or a reduction in their contracted rates, in exchange for a more flexible approach to payment integrity.

What does this mean for employers?

Without considering the total cost of care savings a carrier can provide, an employer may not have the full financial picture in selecting a health insurance carrier. Employers looking to optimize their total cost of care strategy can:

- Talk to their UnitedHealthcare account representative to understand the potential savings delivered through UnitedHealthcare’s broader total cost of care strategy

- Talk to their broker or consultant about how their business is considering UnitedHealthcare’s ability to drive total cost of care

For more information on the results from these studies, please contact your broker or UnitedHealthcare representative.