7 tips to get the most out of your health plan

Are you missing out on using benefits included with your health plan? It might be likely — because it's easy to lose track of the many benefits you could take advantage of. Just like we might need to do some digging in other areas of life — like when we're buying a car or getting a second opinion, learning about your health benefits might be well worth your while. Let's take a look at 7 ways you might be missing out on your health plan benefits.

1. Review your full set of benefits

$55 billion: American missed preventive care opportunities every year.1 “Or that” stat: $21 billion: The amount Americans have in unused gift cards.2

The short story may be “out of sight, out of mind.” Lots of us have at least one unused gift card stashed in a drawer. Too often, that’s also how it is with our health care benefits. You feel fine and you’re busy, so it’s all too easy to skip preventive care like an annual screening or immunizations. (In fact, only 8% of Americans get routine preventive care.)3 Preventive care can help support your health and help you prevent or avoid illness.

Reviewing coverage may seem complicated and time consuming, so people rarely look beyond basic network and copay information to find the additional benefits the policies contain, like rewards for reaching health and wellness goals or getting help for things like weight loss, smoking cessation or substance use. Sign in to learn about UnitedHealthcare member programs that are available with your plan.

Time reviewing your health insurance = time well spent.

2. Research health insurance options during your open enrollment period

30 minutes or less: The time people spend reviewing health benefits before enrolling.4 “Or that” stat: 6 months: The time people spend researching their next car.5

It’s intuitive to focus time and energy researching big purchases like a car, a vacation or even a TV. But researching your health insurance plan may help ensure you won’t miss out on big portions of your benefits. As part of your research, you may want to consider your costs and your family’s health care needs. Then, once you’ve weighed those factors, take time to look beyond the premiums, deductibles, and HMO and PPO categories. Your plan may also include additional benefits that you’ll want to keep in mind and take advantage of throughout the year.

3. Get up to speed on health insurance basics

80% of people think they understand their health care benefits. 49% actually do.6 “Or that” stat: 75% of people think they’re above-average drivers.7

Life is busy. And maybe just having health insurance is a box you’ve checked, and you’re ready to move on to other things. But it pays to take just a few minutes to look through all your benefits.

If you’re a UnitedHealthcare member, you can sign in and easily get a quick view of all your benefits. You’ll see your plan, who’s covered on it, common medical services and the ability to search for providers.

Knowing the details of your health plan may help you get the most value out of your benefits. Learn about how health insurance works, insurance costs and common terms.

But, if you’re not sure of something, it may help to get a second opinion. In fact…

4. Get a second opinion

21% of patients seek a second medical opinion.8 “Or that” stat: 33% of people get a second opinion on their outfits.9

Do you ask more people about which jacket you should buy than about your health diagnosis, condition or treatment plan? You’re not alone. Many of us regularly check in with family, friends and coworkers on dinner plans, what we’re streaming and the clothes we’re buying. But your health is way more important than that jacket — and it deserves a second opinion too.

In fact, when patients get a second opinion, it may lead to a different diagnosis 35% of the time. Second opinions reduced diagnostic errors from 26%-50%. A third opinion lowered it to 16%.10

When should you get a second opinion on your medical care?

If you’ve just been diagnosed with a rare condition or a new health condition that needs treatment, if your treatment isn’t helping or you’re not confident about your treatment plan (especially if it involves surgery) or if you’re struggling with a chronic disease, consider a second opinion.

Most insurance plans include the option to get a second opinion as a standard no-cost benefit. Most UnitedHealthcare members can get second opinions through 2nd.MD, where specialists are available by phone or video conference. Call 2nd.MD at 1-866-269-3534.

Life changes. Maybe your health plan should too.

5. Check your health benefits before you re-enroll to ensure it meets your needs

Fewer than 20% of people update their health benefits each year.11 “Or that” stat: 63% percent of your friends updated their Facebook status this week.12

5 questions to ask to help make sure your health benefits match any changes in your health, family or finances.

When we’re automatically re-enrolled in a health insurance policy year to year, we may not think about any tweaks our coverage might need. Life changes, so it’s a good idea to review your plan (and even your finances) before open enrollment to help ensure you’re getting the best value for your needs. Even your current insurance company may have a range of plan options to help meet your changing needs. Consider these 5 questions:

- Has your plan’s network changed?

- Do the doctors you see still accept your insurance?

- Are you seeing a doctor more or taking more prescriptions than you used to?

- Do you need a plan with more coverage, or would you rather reduce monthly costs?

- Has your job or your family structure changed?

Once you have the full picture of your family’s current health and financial situation, you can assess your plan options and make sure you’ve got the best health insurance coverage for your needs.

But even then, we sometimes need a little extra support.

6. Use your mental health benefits

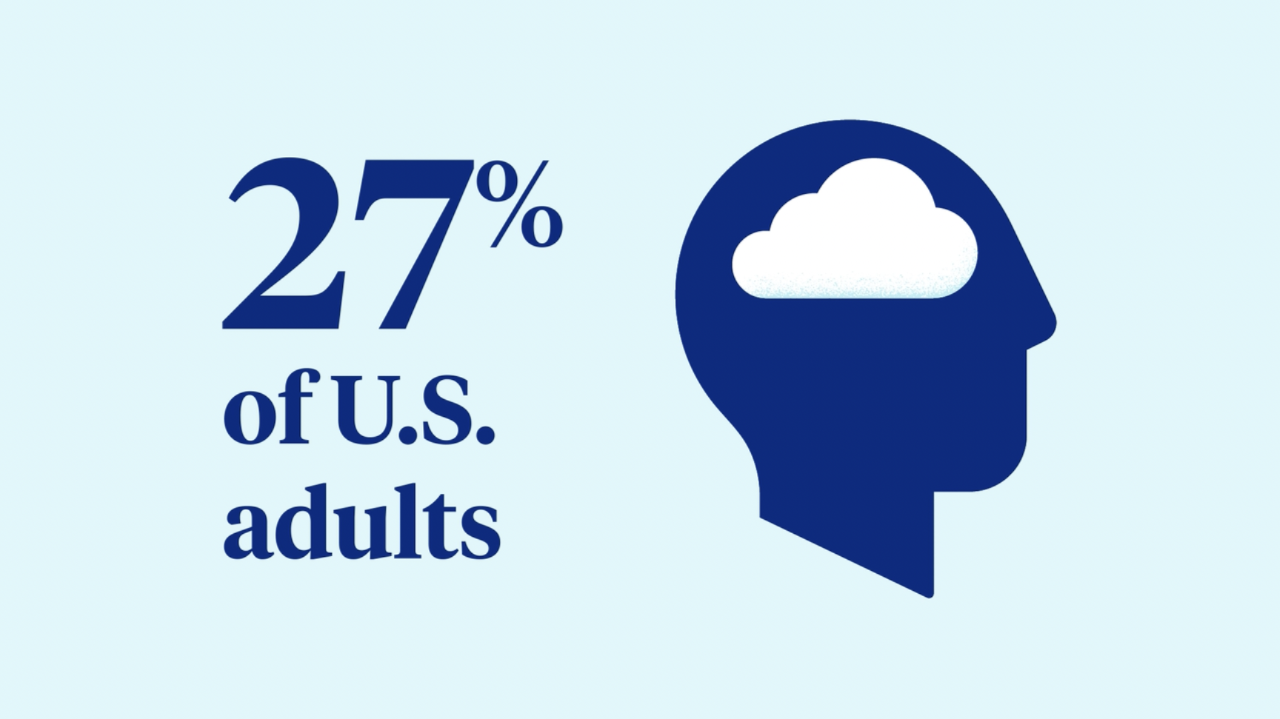

27% of U.S. adults receive mental health treatment. 4% know it may be covered.13 “Or that” stat: 55% of us watch “comfort TV” to relieve stress or anxiety.14

Mental illness is much more common than most people realize. Many people face emotional and mental health struggles, including feelings of anxiety, stress, isolation, or depression — and need help to cope.

“Our mental and physical health are interconnected; an illness rarely affects a single body part or system,” says Dr. Rhonda Randall, D.O., Chief Medical Officer at UnitedHealthcare. “When you consider that nearly 1 in 5 adults live with a mental illness, and 6 in 10 adults in the U.S. have a chronic disease, it's easy to consider how one might impact the other.”

Many employers provide mental health coverage, and as the demand for behavioral health care has grown, many providers and insurers are working to ensure patients get the care they need in the ways they need it.

“Our network of behavioral health providers has evolved into the largest in the country, with more than 300,000 mental health providers,” says Kelley Nolan-Macionne, Senior Vice President of Product and Innovation at UnitedHealthcare.

Sign in to your member account and find mental health care providers or choose “Find Care” in the UnitedHealthcare mobile app.

Money can’t buy happiness — but saving some can’t hurt.

7. Save money with health spending accounts

65% of people don’t know the difference between an HSA, FSA and HRA. “Or that” stat: 65% of people can tell you what TMI means.

Did you know there are three kinds of health spending accounts? They include Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs) and Flexible Spending Accounts (FSAs). These options, which may be offered during open enrollment, give you a tax-free way to save and may help reduce the cost of doctor appointments, medication and more. Compare the details about each type of account to learn which one may be right for you.

If your plan includes the option to open a health savings account, you can enroll now. Open an HSA with Optum Bank

Health coverage that's there for what matters

46 million Americans are enrolled in UnitedHealthcare plans. Helping you find value in your healthcare is what we do. UnitedHealthcare is committed to helping people live healthier lives and making the health system work better for everyone. After all, that’s the point of health insurance — and the point of added programs your policy may contain to support your health. The more you know your insurance, from incentives to HSAs, the more value — and health — you may get back.