When it comes to making Medicare decisions, you may be considering a Medicare supplement insurance plan, also known as a Medigap plan. A Medigap plan helps pay some of the out-of-pocket costs that Medicare Parts A & B doesn’t, such as deductibles, copayments and co-insurance.

When can I get a Medigap plan?

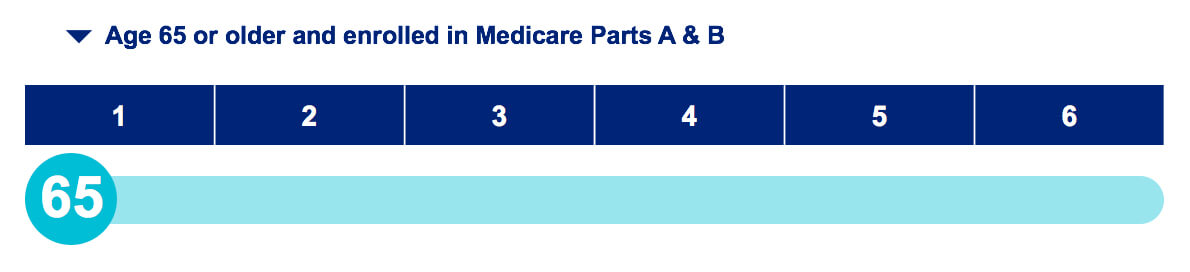

You can apply to buy a plan at any time; however, you do have a 6-month Medicare Supplement Open Enrollment Period that begins the first day of the month in which you're both age 65 or older and enrolled in Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you enroll during this time you are guaranteed coverage regardless of health status.

If you miss the Medicare Supplement Open Enrollment Period or Guaranteed Issue periods, you can still apply for a Medigap plan at any time. However, restrictions and/or underwriting for current health status may apply in states that allow it.

What if I need to change my Medigap plan?

If your health, financial or lifestyle needs change and you want to explore other plan options, yes, you can change your Medigap plan. You can apply for a different Medigap plan at any time during the year but doing so outside of your Medicare Supplement Open Enrollment Period or a Guaranteed Issue period means there is no guarantee of coverage and that your past health history may influence plan premiums.

You can learn more about the basics of Medicare supplement insurance plans here.

About Medicare Made Clear

Medicare Made Clear brought to you by UnitedHealthcare provides Medicare education so you can make informed decisions about your health and Medicare coverage.

Get the latest

Boost your Medicare know-how with the reliable, up-to-date news and information delivered to your inbox every month.

*All fields required