No Surprises Act: safety from unexpected medical bills

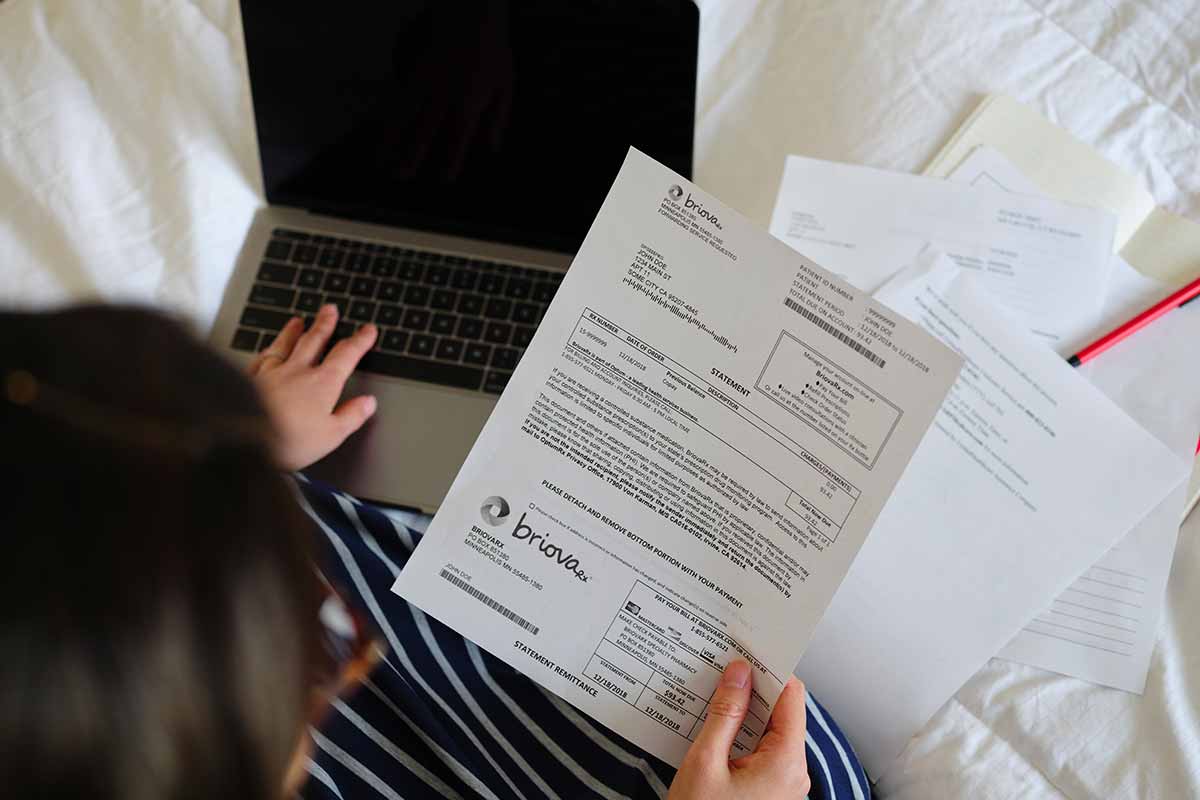

For years, many insured patients who needed emergency treatment or hospitalization had another emergency to worry about: Would they be able to pay the bill for their care?

That’s because, until 2022, it was perfectly legal for out-of-network providers who participated in your care — say, the anesthesiologist who monitored your surgery or the air ambulance that got you to the hospital — to charge you for the services that you very much needed. Instead of accepting your insurance plan’s discounted rate, they could bill you for the difference between that and their full fee. But thanks to the No Surprises Act, that practice (known as balance billing) is now outlawed unless you provide consent (more on this below).

The protection couldn’t have come soon enough. A 2020 study by the Peterson-KFF Health System Tracker estimated that 1 in 5 emergency claims and 1 in 6 in-network hospitalizations included at least 1 surprise bill for out-of-network services. And in 13% of cases, those bills amounted to more than $2,000 in expenses for patients.

Now that the No Surprises Act is in full effect, it’s important to understand exactly what it can — and can’t — do for you. We spoke to an expert to get all the details so you can reap the law’s full protection.

What does the No Surprises Act cover?

The law applies to people with private health insurance, and it covers most emergency care in:

- An air ambulance

- A hospital ER

- A freestanding emergency room

“Everything that happens until the patient is stabilized is covered by the law,” says Myra Simon, a health insurance adviser at Avalere Health. The protections still apply even if the final diagnosis determined by the emergency room is not something most people would consider an emergency. So if your severe abdominal pain turns out to be gas, not appendicitis, your plan can’t deny coverage of the service just because of the final diagnosis.

The No Surprises Act also applies to certain nonemergency care. If you have a planned procedure at an in-network hospital or facility, no one who treats you there can charge more than the in-network rates, regardless of whether they’re individually part of your plan.

Read any paperwork providers give you before or at the appointment closely. According to Simon, this includes forms you might fill out online in advance of an appointment. If an out-of-network specialist is going to provide care, they need to provide a written consent form along with a cost estimate and a list of other providers who are in-network within 72 hours of treatment.

“If you are asked to consent to receiving out-of-network care in the forms, you can decline,” says Simon. “If you need information in a language other than English and/or have a disability and need accommodations to access the information, you have a right to support in another language, and/or accommodations for any disabilities.”

What doesn’t the No Surprises Act cover?

There are a few important costs and facilities that the law does not cover. Those include:

- Deductibles

- Copays and coinsurance

- Ground ambulances (even in emergencies)

- Out-of-network urgent care centers

- Birthing centers

- Nursing homes

If you think there’s an error with your situation, you can also file a complaint. Patients can contact a new federal hotline called the No Surprises Help Desk at 800-985-3059.

How can you avoid surprise bills?

“While the No Surprises Act provides important protections and shines a light on health care price variation, there are things you can do to help avoid an unexpected medical bill,” says Dr. Donna O’Shea, chief medical officer of Population Health at UnitedHealthcare. Here are 3 strategies to keep in mind:

- Comparison shop. Get cost estimates from providers in your area. UnitedHealthcare members can access health care quality and cost information for more than 820 common medical services by signing in to myuhc.com and selecting the “Find Care & Costs” tab. On the UnitedHealthcare mobile app, choose “Find Care”.

- Stay in-network. Receiving care from an out-of-network provider or facility can lead to a surprise charge, with the total cost of this type of care exceeding $40 billion for Americans each year. “While the No Surprises Act helps reduce the chance you will be left with a big bill if an out-of-network provider is involved with your care, it’s important to always start with in-network health care professionals and facilities for nonemergency care,” Dr. O’Shea advises. “That includes when your primary care physician refers you to labs for bloodwork, an MRI or other tests. One red flag to watch for is if an out-of-network care provider seeks payment in full before delivering services. Avoid these types of providers; UnitedHealthcare members can find in-network options in the app, on our website or by calling the number on your card.”

- Be sure your screenings are covered. While many health plans cover preventive services, like wellness visits, mammograms or colonoscopies, some advanced screenings may not be considered preventive services. Those can result in an out-of-pocket charge. To help avoid that, confirm with your health plan that any services or tests are covered under your benefits. If needed, you can also work with your health care provider to complete a preauthorization form in advance.

What if there’s a billing mistake?

Even in light of the No Surprises Act, and even if you’re insured and have full trust in your medical provider, billing mistakes and errors can happen. Here’s how to help protect yourself.

Before or around the time you’re billed, you’ll receive an explanation of benefits (EOB). This is not an actual bill, but it lists key information: what your plan paid, what you might owe and where you stand with your deductible. It says “THIS IS NOT A BILL,” and because of that, many people ignore it. But it’s a great way to make sure you’re not being charged for services you didn’t receive.

“If you see a charge you weren’t expecting, first, talk with the support staff at the hospital or doctor’s office to request that the charge be waived or reduced,” says Dr. O’Shea. “If needed, some health plans offer access to resolution support to help negotiate on behalf of members with hospitals and care providers. If you receive a surprise bill from an out-of-network care provider, call the number on your insurance ID card to alert your health plan and check on assistance.”

Many insurers’ websites let you view your bills. For example, UnitedHealthcare members can view their bills online by signing in to your account or in the My Plan section of the UnitedHealthcare app. This will show everything being billed to the member, everything UnitedHealthcare paid and requests from the providers to UnitedHealthcare for payment. Dr. O’Shea adds, “If there’s an overcharge to you, or if the provider charged for a service you didn’t receive, and if you’re not getting help from your insurer, you can contact the No Surprises Help Desk at 1-800-985-3059.”

More articles

More articles

Shopping for a plan?

Find what you’re looking for, from individual plans to Medicare and more. Learn about your options and get online quotes.