Medicare Part D Creditable Coverage

What is Creditable Coverage?

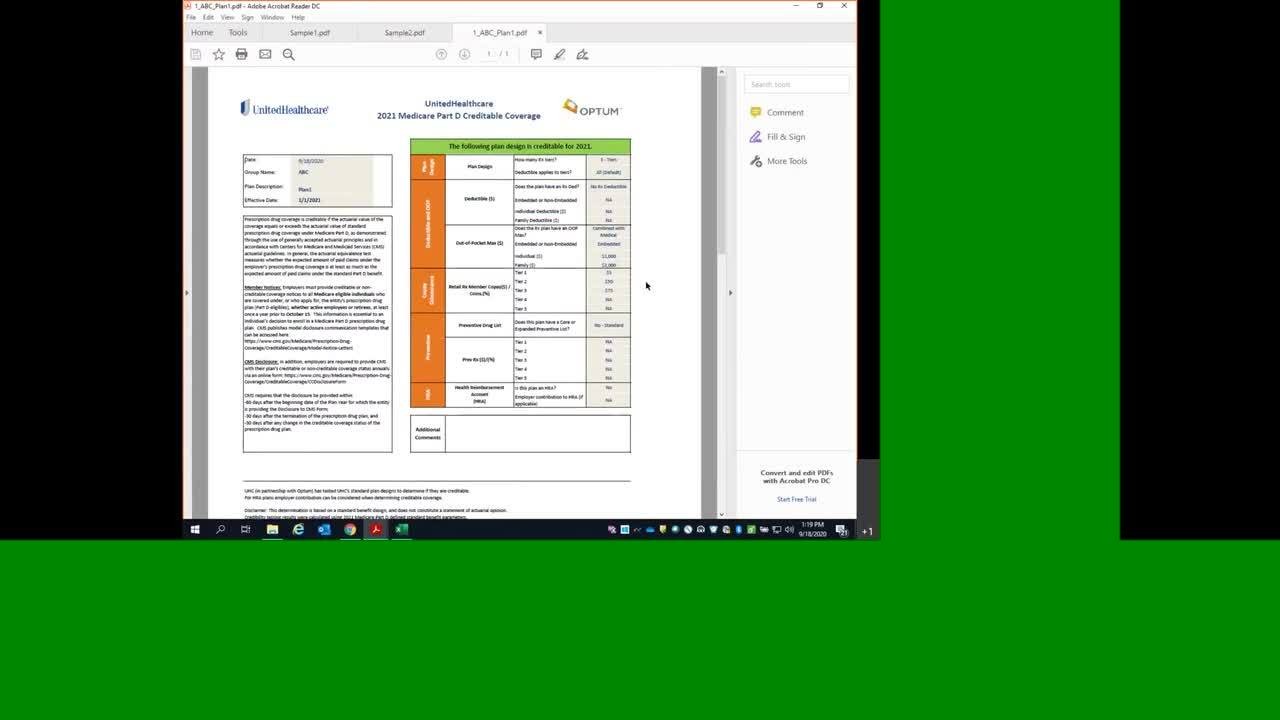

Prescription drug coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with Centers for Medicare and Medicaid Services (CMS) actuarial guidelines. In general, the actuarial equivalence test measures whether the expected amount of paid claims under the employer's prescription drug coverage is at least as much as the expected amount of paid claims under the standard Part D benefit.

See the frequently asked questions for more information or visit the CMS Creditable Coverage website for more information about creditable coverage, including access to model disclosure communication templates published by CMS. Updates are made regularly, so please check the websites often for the most up-to-date information.

What do you need to do?

The Medicare Modernization Act (MMA) mandates that certain entities offering prescription drug coverage, including employer and union group health plan sponsors, disclose to all Medicare eligible individuals with prescription drug coverage under the plan whether such coverage is “creditable”. This information is essential to an individual's decision whether to enroll in a Medicare Part D prescription drug plan.

If an employer offers a prescription drug plan to Medicare eligible individuals, understand that:

- Annually, Optum performs the actuarial equivalence test for UnitedHealthcare’s standard benefit designs. Creditable coverage results can be accessed via the 2025 Creditable Coverage Results section below

- Small Business plans should reference the “UHC 2025 Creditable Coverage Results (Small Business Only)” file

- Other plans should utilize the “UHC 2025 Creditable Coverage Results” lookup tool

- Determine if the employer plan provides “creditable coverage”.

- Communicate the creditable or non-creditable status of the employer plan to your client so that they may communicate the status to their members.

- Creditable coverage determinations are only valid for groups that have medical and prescription drug coverage with UHC. This determination should not be used for groups where prescription drug coverage is carved out to another pharmacy vendor.

NOTE: 2025 Creditable Coverage tools are available below.

Employer responsibilities

Member notices. Employers must provide Notice of Creditable Coverage (NOCC) to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligible). This disclosure must be provided to Medicare eligible active working individuals and their dependents, Medicare eligible COBRA individuals and their dependents, Medicare eligible disabled individuals covered under the prescription drug plan and any retirees and their dependents at least once a year prior to October 15. This information is essential to an individual's decision to enroll in a Medicare Part D prescription drug plan. CMS publishes model disclosure communication templates that can be accessed here.

- This is mandatory at least once a year by no later than October 15.

- The Client, NOT UnitedHealthcare, sends Creditable Coverage notices to its members.

- The Client can pay UnitedHealthcare to send Creditable Coverage Notices to members on its behalf.

CMS disclosure. In addition, employers are required to provide CMS with their plan's creditable or non-creditable coverage status annually via an online form, found here.

Additional information

Retiree drug subsidy. If the employer coverage is creditable, plan sponsors may be eligible to pursue a subsidy through the Retiree Drug Subsidy (RDS) Program. This optional step requires additional testing and an application process. They can apply for the subsidy by going to: www.rds.cms.hhs.gov.

They must apply for the subsidy 90 days prior to the beginning of an RDS plan year, which can mirror a benefit plan year. For example, if their benefit plan year begins January 1, and the client wants their RDS plan year to be the same, they would apply for the subsidy by October 1. If they request an extension, CMS will grant an additional 30 days to complete the application.

Simplified determination. CMS has clarified that if an employer is not applying for the subsidy, the employer can determine that its prescription drug plan's coverage is creditable if the plan design meets all four of the following criteria:

- Provides coverage for brand and generic prescriptions;

- Provides reasonable access to retail providers and, optionally, for mail order coverage;

- Is designed to pay on average at least 60 percent of participants' prescription drug expenses; and

- Satisfies the following:

- For employers that have a stand-alone prescription drug plan;

- The prescription drug coverage has no annual benefit maximum benefit or a maximum annual benefit payable by the plan of at least $25,000; or

- The prescription drug coverage has an actuarial expectation that the amount payable by the plan will be at least $2,000 per Medicare eligible individual.

- For employers that have integrated health coverage, the integrated health plan has no more than a $250 deductible per year, has no annual benefit maximum or a maximum annual benefit payable by the plan of at least $25,000 and has no less than a $1,000,000 lifetime combined benefit maximum.

Plans that meet these four criteria are deemed to be creditable.

UnitedHealthcare Medicare Part D Creditable Coverage test results

Calendar year plans should be tested against the 2025 Medicare Part D parameters. If the plan design subsequently changes prior to 1/1/2025, the plan should be re-tested to determine if there is a change in creditable coverage status. Any change in creditable coverage status should be disclosed to members.

Off-calendar year (2024-2025) plans should be tested against the 2024 Medicare Part D parameters. If the plan design subsequently changes for the 2025-2026 renewal/coverage period, the plan should be retested against the 2025 Medicare Part D parameters to determine if there is a change in creditable coverage status. Any change in creditable coverage status should be disclosed to members.

2025 Creditable Coverage Results (Small Business Only)

Small Business is defined as group size 1-50 in all states except CA, CO, NY where small group is also defined as group size 1-100.

- UHC 2025 Small Group Plan Lookup - If your browser does not allow you to use the “open” feature, please select “save” or “save as” to view the tool.

2025 Creditable Coverage Results

If your plan is not a small group plan, please use these results to determine if your plan is creditable.

- UHC 2025 Plan Lookup - If your browser does not allow you to use the “open” feature, please select “save” or “save as” to view the tool.

UHC Creditable Coverage Testing Lookup Tool Training