Breaking down the conditions raising employer health care costs

Employers are struggling to cover health care costs for those employees who have serious health conditions.

Today, 60% of U.S. adults are living with at least 1 chronic condition and 40% are living with 2 or more.1

As Millennials — who now represent the majority of the workforce — age, employers are more likely to have employees who are at-risk of, or receive treatment for, chronic conditions. In fact, 41% of employers expect to see higher chronic condition management needs in the future due to more occurrences of these conditions and a higher level of severity.2

Anticipating a higher prevalence of serious or chronic disease diagnoses matters because the management of these conditions can be complex and expensive, often requiring:

- Costly treatments

- Specialty medications — which can account for nearly half of an employer’s health care spend3

- Hospitalizations

- Higher utilization of medical services

Because of this, it’s not surprising that many employers are seeking strategies to help employees and their families more effectively manage their health and reduce their overall cost of care.

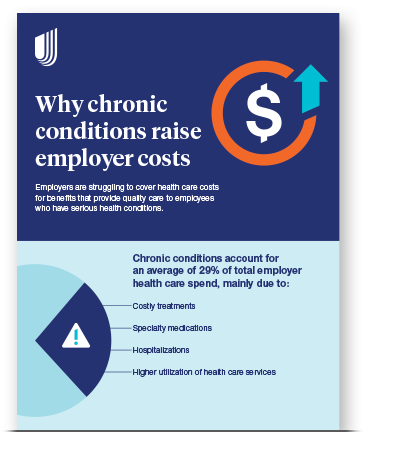

Why chronic conditions raise employer costs

Employers are struggling to cover health care costs for benefits that provide quality care to employees who have serious health conditions.

In fact, 55% of surveyed employers ranked chronic condition management as the No. 1 area they felt could benefit most from health care innovation.4

And it’s no wonder: Chronic conditions account for an average of 29% of total employer health care spend, mainly due to costly treatments, specialty medications, hospitalizations and higher utilization of health care services.5

3 costliest chronic conditions

Looking at UnitedHealthcare data,5 chronic conditions account for 29% of total employer health care spend, with 3 illnesses costing employers the most per member per month (PMPM):

- Musculoskeletal conditions affecting the bones, muscles, joints and certain connective tissues — such as back problems, arthritis and osteoporosis — cost employers $52 PMPM on average

- Neoplasms, abnormal tissue growths like benign or cancerous moles and tumors, cost employers $43 PMPM on average

- Circulatory disorders affecting the heart and blood vessels — such as an abnormal or irregular heartbeat, heart disease or other chest pain — cost employers $43 PMPM on average

Employees who have metabolic conditions — which can lead to more serious disease down the road — drive the majority of costs associated with those chronic illnesses. Examples include obesity, hypertension and diabetes. In fact, 86% of what employers spend on circulatory disorders can be attributed to metabolic conditions, such as congestive heart failure, which costs approximately $80,000 per claimant, according to UnitedHealthcare data.5

Perhaps more alarming is that 28% of UnitedHealthcare members have a metabolic condition yet drive 56% of total health care spend. This averages to $12,000 per member, which is 4 times more than those without metabolic conditions.5 Additionally, chronic diseases and their associated risk factors cost employers $36.4B annually in lost productivity and missed work.6

“At UnitedHealthcare, we’re striving to reach members newly diagnosed with a chronic disease sooner in order to make a difference earlier.”

It’s important to note that UnitedHealthcare data indicates that some of these conditions impact different demographics more than others. For instance, circulatory disorders disproportionately affect men, who account for 64% of spend, and Baby Boomers, who make up 45% of spend.5

Worth noting

Top trend drivers that account for the highest year-over-year cost increases for employers with UnitedHealthcare health plans are respiratory conditions, mental health and pregnancy.5

Strategies for better chronic condition management and lower costs

Managing chronic conditions can be a long and costly road for both employees and employers, but there are strategies that can help.

“Our goal is to help employees adhere to treatment plans, identify social determinants of health risks and enroll them in clinical programs when available,” Randall says.

Employers can also play a role in helping their employees manage or prevent chronic conditions by promoting a healthier workplace and providing support, which can help to reduce costs associated with chronic conditions. Here’s more:

Encourage preventive care

Consider health plans designed to encourage employees to engage in preventive care via employee communications and wellness programs with incentives or rewards. Selecting a health plan that requires employees to see a PCP to direct their care may also help prevent later-stage diagnoses.

Promote health and wellness

Unhealthy habits or behaviors, such as tobacco and alcohol use, poor nutrition and physical inactivity, can increase the risk of chronic disease. Developing or investing in health and wellness programs like UnitedHealthcare Rewards may encourage employees to complete healthy activities, so they can earn rewards that can help them get on a path to better health.

Offer benefits designed to provide financial support

Along with medical and wellness benefits, employers also have the option to include financial benefits in their health plans. These resources can include one-on-one financial coaching, online educational sessions, budgeting tools and more. Employers can also help alleviate the financial stress that can come with managing a chronic condition by choosing health plans that offer $0 copays for services like primary care, virtual care and urgent care visits or condition-specific coverage for necessary treatments, devices or procedures.

Invest in care management and clinical programs

Programs designed to step in and help employees and their families navigate care with a combination of timely outreach, clinical support and personal guidance can make a big difference for those managing chronic conditions. The goal with these programs is to get employees and their families the most appropriate care and treatment for their condition at the lowest possible cost.