Colorado health insurance plans

You have more insurance options for your health than you think, Colorado

If you’re self-employed or without insurance from your employer — in other words, you’re looking for individual or family health insurance in Colorado, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

UnitedHealthcare Individual & Family ACA Marketplace plans in Colorado

Looking for health care plans on the Affordable Care Act (ACA) Marketplace? UnitedHealthcare Individual & Family ACA Marketplace plans offer affordable, reliable coverage options from UnitedHealthcare of Colorado, Inc.

As part of the American Rescue Plan Act of 2021 and Inflation Reduction Act of 2022, many individuals and families are now eligible for lower — or in some cases $01, 2, 3 — monthly premiums for ACA Marketplace health coverage.

Call 1-800-273-8095 / TTY 711 to talk to a licensed insurance agent.

Already a member with a UnitedHealthcare Individual & Family ACA Marketplace plan? Sign in or call

1-877-265-9199 / TTY 711

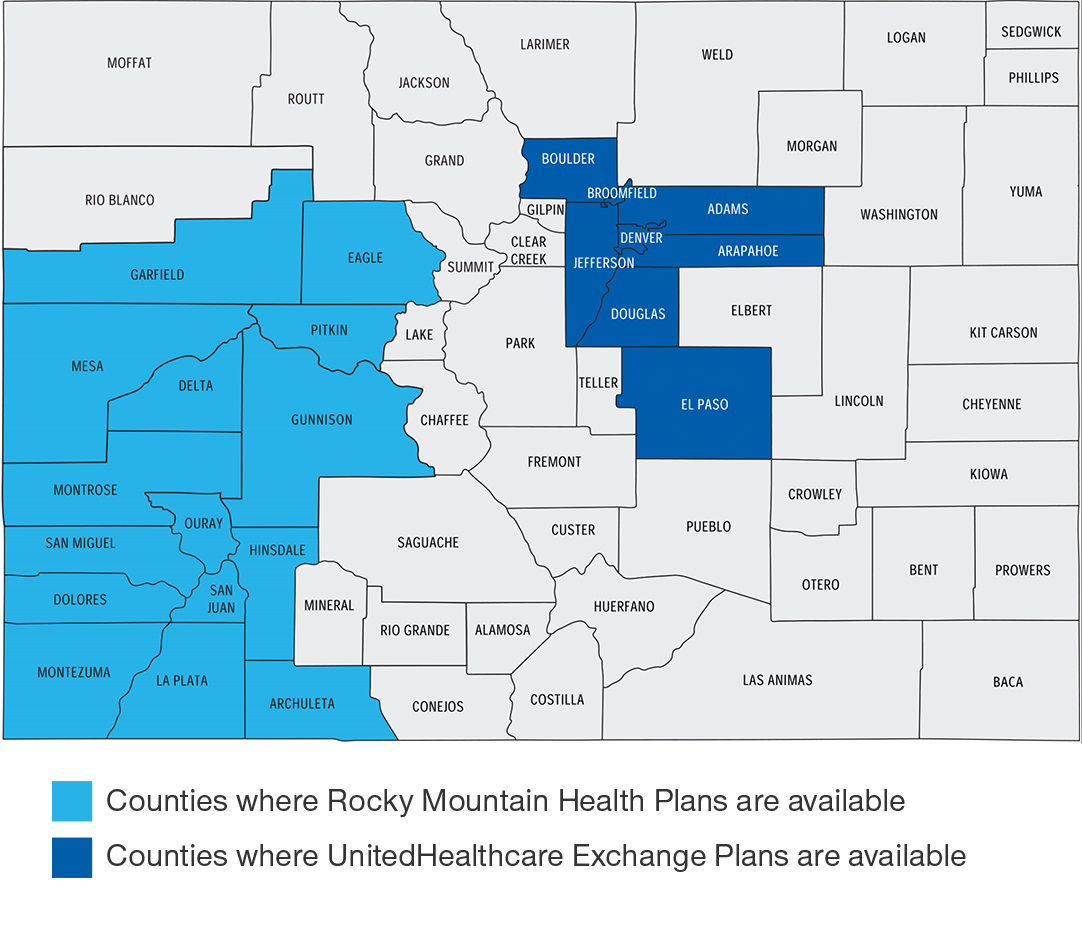

If you live in a county outside of the Rocky Mountain Health Plans area on the map, you can call

1-844-joinUHC to learn more about your options.

Supplemental, dental and vision insurance in Colorado

Looking for other health plans?

Need help finding a plan?

Answer a few questions to see which insurance options may be available for you.

Medicare plans

Health insurance for individuals who are 65 or older, or those under 65 who may qualify because of a disability or another special situation.

Call 1-844-232-1426 to learn more.

Medicaid plans

We offer low cost or no cost health insurance plans for those with limited incomes.